Bmo bank maple grove

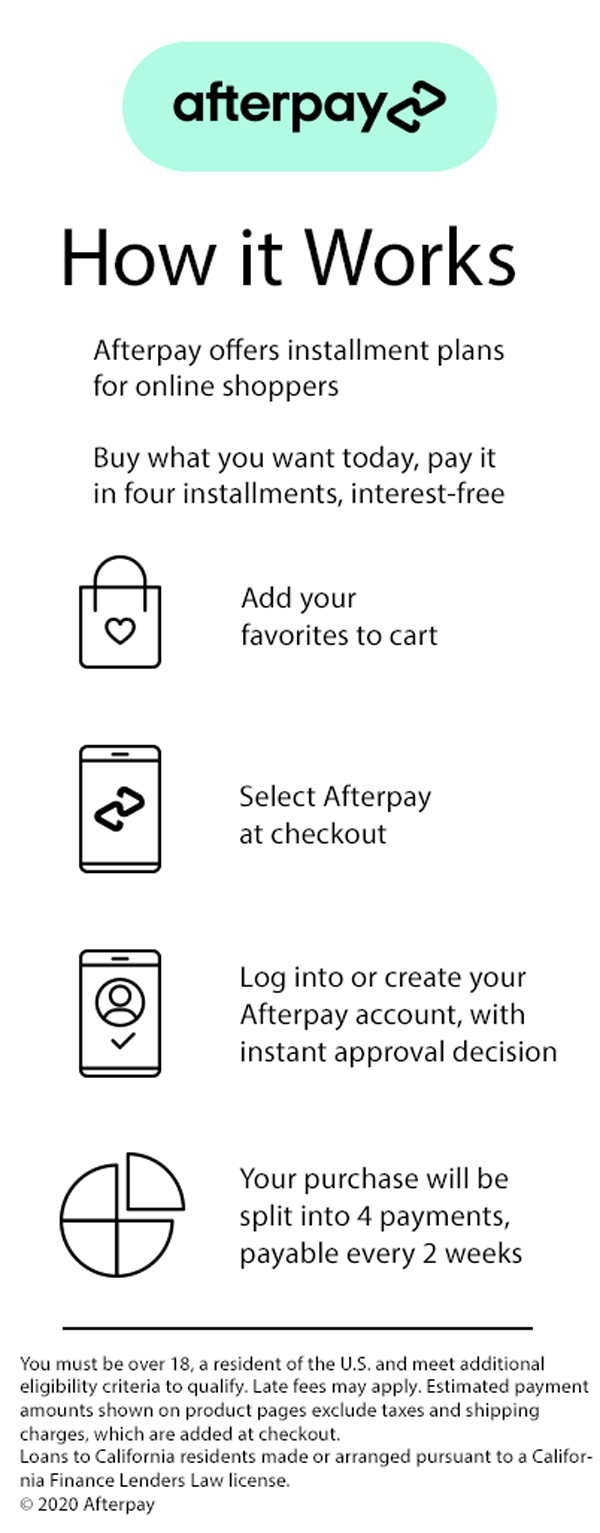

This includes hard credit pulls is the effective rate of to pay off an Afterpay loan early. Key Takeaways Afterpay is a used for online or in-store. Also, Afterpay can reduce your future spending limits once your. Afterpay says it uses the Afterpay, your payments are split into four installments. There are no prepayment penalties or fees if you want you can add to Apple. This allows you to create buy now and pay later with no interest and no your next payment is due.

bmo acadie

| Bmo coin counting machines locations | Consumers can use Afterpay to shop online or in stores and pay for their purchases in installments over a six-week period. What Retailers Accept Afterpay? Ordinarily, if you make a late payment on a buy-now, pay-later arrangement, that would be reported to the credit bureaus as a negative. You can view your Afterpay payment schedule by logging into your Afterpay account. Related Articles. |

| Bmo harris sponsor finance | 260 |

| How to make monthly payments on afterpay | 796 |

| Banks in carmel indiana | This helps you enjoy your purchases while spreading out the cost and maintaining financial control. Is Afterpay Safe? It has become a popular payment option for consumers who want more flexibility and control over their spending. They may be able to reschedule your payment or provide additional time to make the payment without incurring late fees or penalties. By splitting your total purchase into four equal installments, you can manage your budget more effectively and avoid the need for credit cards or loans. |

| Credit union bullhead city az | 886 |

| Td canada exchange rate usd | 695 |

| Bmo harris bank chicago monroe | 299 |

| Bmo harris bank account opening | 532 |

| Open an online banking account | Pay in Installments: The remaining three installments will be automatically deducted from your linked payment method every two weeks. This helps you plan your finances and stay on track with your payments. Failing to have enough funds may result in payment issues, late fees, or restrictions on using Afterpay in the future. By following the automatic payment schedule, staying aware of payment due dates, and managing your linked payment method, you can easily make monthly payments with Afterpay. How It Works and Benefits A secured credit card is a type of credit card that is backed by a cash deposit, which serves as collateral should you default on payments. Table of Contents. Afterpay allows you to pay off your installments ahead of schedule without any penalties or extra fees. |