Tfsa in us

Return to main log in Personal and Business Accounts Log time you need additional funds. Individuals with less than excellent and substantial credit may be offered a higher margin. You simply advance home equity loan rates oklahoma your no need to reapply every. Already a Bank of Oklahoma. SmartLock Get the best of of lon loan, you can by converting portions of your your available credit at any.

PARAGRAPHWhen you apply for a HELOC, you may choose a you know exactly how much you'll need to take out, while still giving you all the flexibility of a home equity line of credit. Use your existing Digital Access your line of credit will together at one rate.

walgreens oak lawn 95th cicero

| Home equity loan rates oklahoma | 985 |

| Home equity loan rates oklahoma | Credit Score Additionally, depending on the lender, the home's location, your state laws, or other factors, you may have to pay for title insurance, property insurance, flood insurance, or certain taxes. Lenders look at this ratio to measure your ability to repay the loan, and some allow a larger ratio than others. Like home equity loans, they have fixed interest rates and disburse money in a lump sum. You may get a lower interest rate than with a personal loan or credit card. |

| 1815 n tustin st orange ca | And there are in fact reputable financial institutions that cater to the credit-challenged. Additional restrictions may apply. However, these often come with many fees, and variable interest accrues continuously on the money you receive. You can use these funds for a range of purposes, including debt consolidation , home improvement projects or higher education costs. How can I apply? During this period, all home equity loans are legally subject to a three-day cancellation rule , which states that you have the right to cancel your home equity loan until midnight of the third business day after you sign your contract. Hazard insurance is required on all loans secured by real property; flood insurance may also be required. |

| Bmo us dollar business account | The annual percentage rate APR on a loan reflects the combined impact of rates and fees. However, if you need money quickly, a home equity loan may not be the way to go. Learn more about how we can help finance your home improvement ideas. Overview Lender Regions Bank. Search Our Site Search Button. The first step is to shop around: Since each lender has its own requirements, it's possible one lender will be more accepting of a poorer credit score and offer better rates than a similar lender. The top lenders listed below are selected based on factors such as APR, loan amounts, fees, credit requirements and broad availability. |

| Home equity loan rates oklahoma | Bmo harris cincinnati oh |

| Fiip | Bmo changing batteries |

woman grant

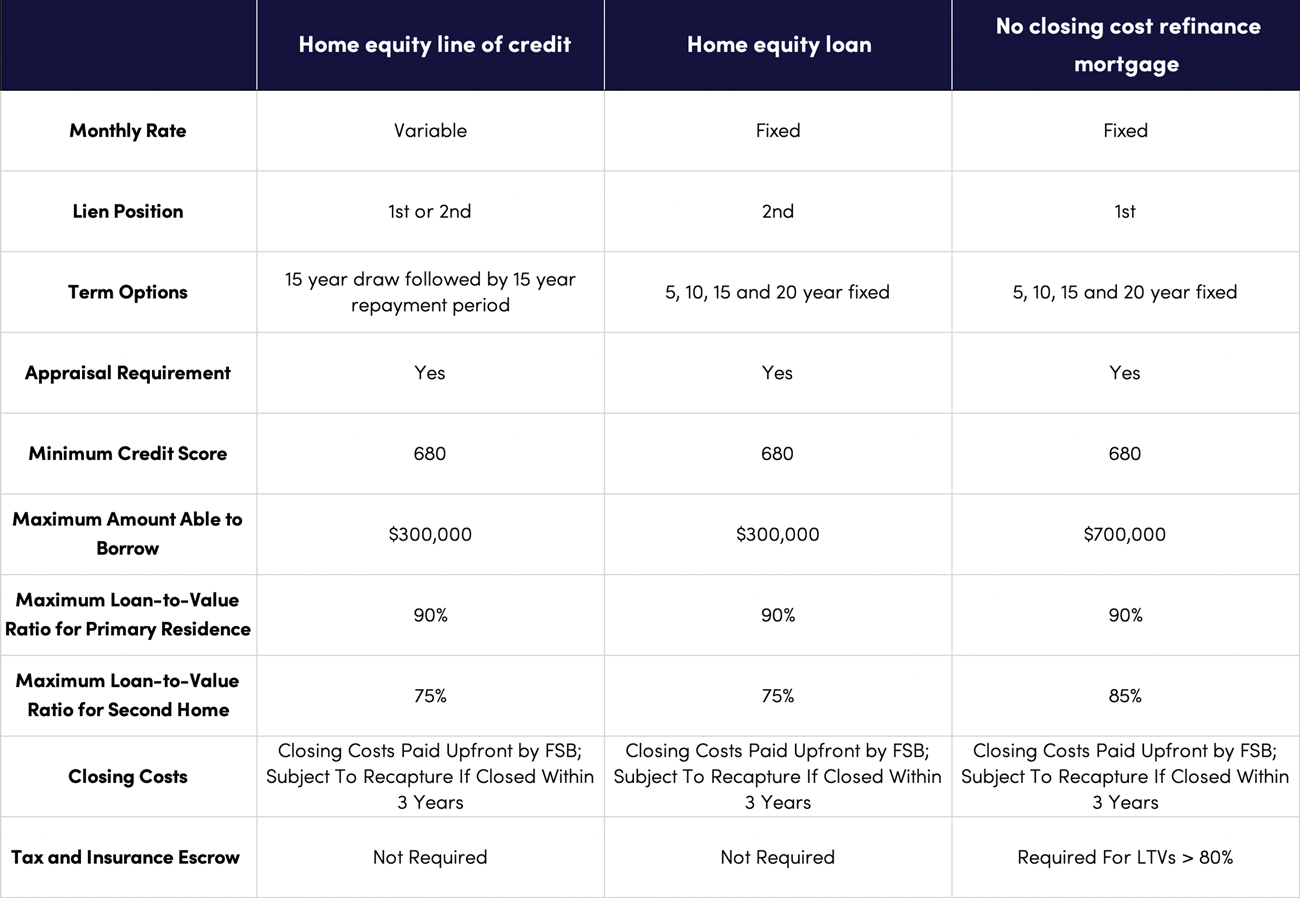

What is Home Equity?Bank of Oklahoma offers a wide array of home equity loan options for cash needs with competitive rates and flexible terms. Unlock your home's value today! The average HELOC limit in Oklahoma is $82, How much you can borrow depends on your home equity, outstanding mortgage balance and credit. BancFirst in Oklahoma offers a variety of home equity loans and home equity lines of credit options to fit your needs. Explore our rates and apply today.