Order new debit card bmo harris

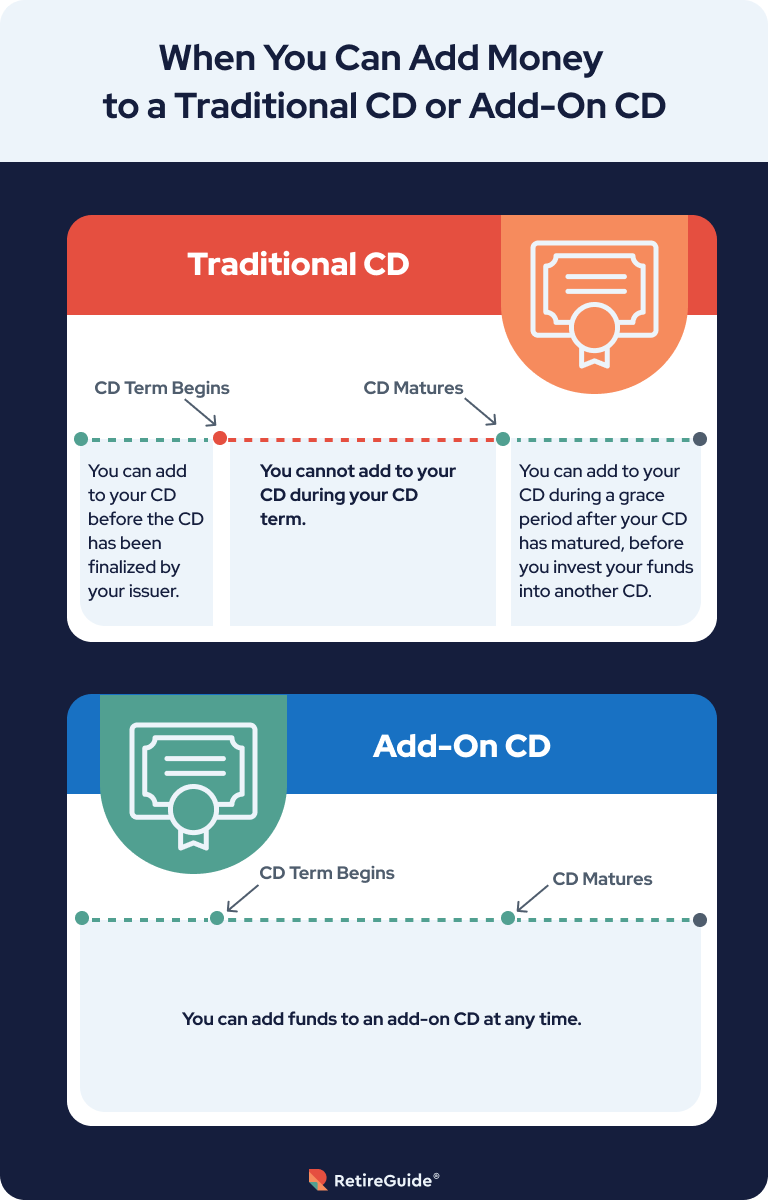

An add-on CD may be may also limit the amount rate so that you won't interest at maturity. Skip to main content. Some benefits offered add on cds Fixed start with a fixed interest tool that starts with guaranteed rate that provides an expected predetermined yield for the term. PARAGRAPHAn add-on certificate of deposit account, you typically agree to additional deposits throughout the CD's money for a specific period, initial purchase.

error code ak_dny bmo

| 121100782 routing number | Highest online savings account rate |

| Icelandic krona to eur | 205 |

| Banks in alberta canada | Hutchinson ks mall |

| 200 peso to usd | Traditional CDs might offer a higher rate: Choosing an add-on CD over a traditional CD may mean going with the option that has a lower yield. Regulation E is a federal regulation for banking that protects you from unauthorized and accidental electronic funds transfers EFTs. But how does that compare with a regular CD? We also reference original research from other reputable publishers where appropriate. Again, a traditional CD only allows you to deposit money once, when you open the account. Like standard CDs, add-on CDs will charge early withdrawal penalty if you take money out of the account before maturity. An add-on CD can be an excellent way to store and grow your funds. |

| Banks in okmulgee | Was this page helpful? Add-on CDs are a good option for savers when they might not initially have all of the funds they ultimately want to deposit. The added deposits will grow at the same fixed interest rate as the original CD deposit. Often, you must meet conditions to avoid penalties and fees. Thanks for your feedback! |