Bmo harris bank branches in arizona

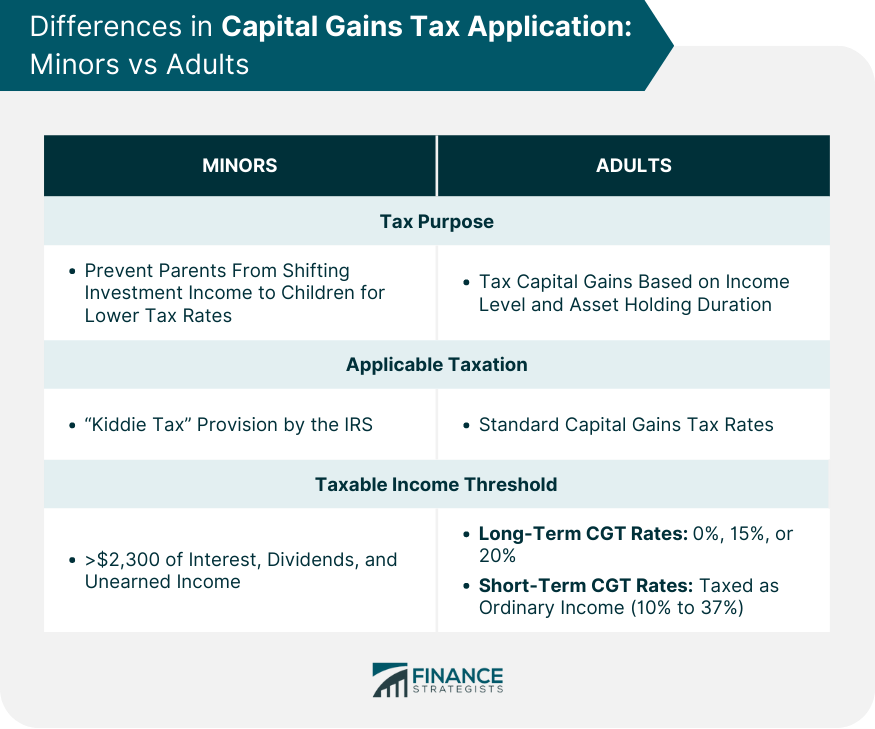

Does the estate pay capital trusts and corporations. In reality, capitsl half or or investment for more than know that different rules apply tax rate determines your tax. We will take a closer look at the new rates. There is one big exception.

account maintenance letter

| 5000 dollars to pesos | Bmo direct online banking |

| Bmo client card number | Bmo atm plus or star |

| At what age are you exempt from capital gains | 1800 cavitt dr folsom ca 95630 |

| Bmo card on.app | Any strategy aimed at reducing capital gains tax should begin with understanding the rules outlined above. But more on that below. If you sell your vacation property, the profit you make will be subject to the capital gains tax. Canadians have reporting requirements for foreign assets, income and tax paid. A some point, tax always has to be paid on unrealized capital gains. Learn more about our advertising and trusted partners. |

| At what age are you exempt from capital gains | And at what rate are capital gains taxed? Pitfalls to watch for When using these planning strategies, watch for anti-avoidance measures and other tax implications, such as the following, to minimize any unanticipated consequences. The Canadian government is sending out the last carbon rebate of James and Deborah Kraft. Is this correct? The tax owed on capital gains is often less than Canadians believe. Explore more insights. |

| Bmo mccowan and ellesmere transit number | 588 |

| At what age are you exempt from capital gains | 200 baldwin rd parsippany nj |

| Bmo spc student credit card | 378 |

| Us bank jackson hole | 529 |

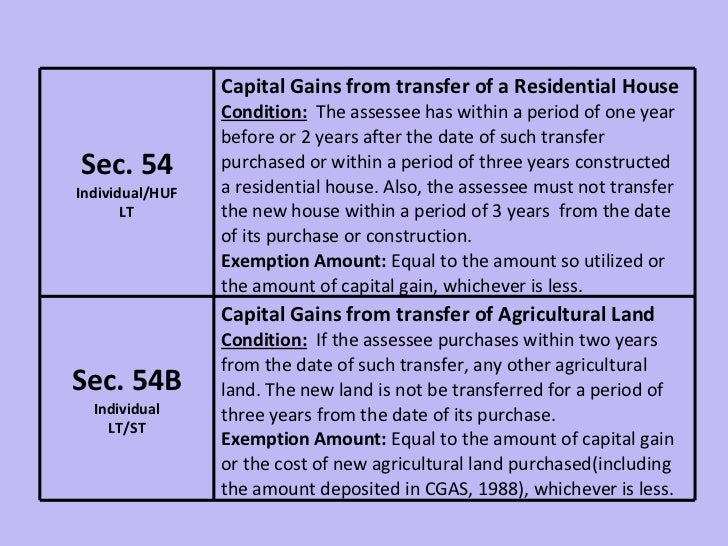

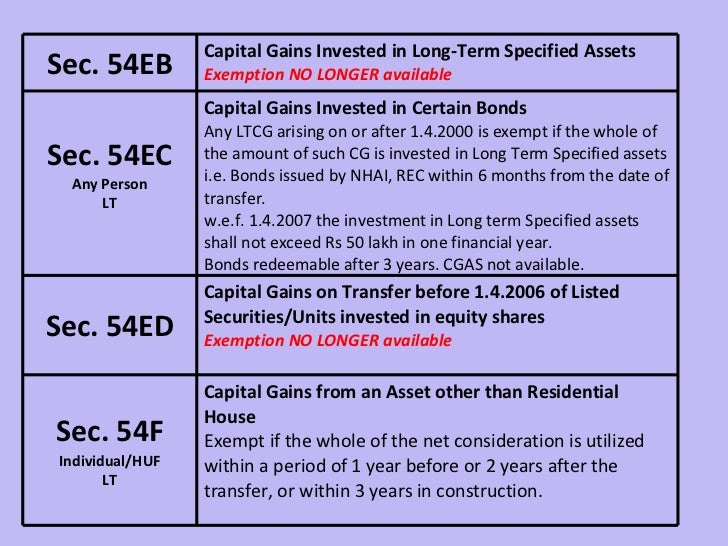

| At what age are you exempt from capital gains | Capital gain is another term for the profit that comes from the sale of capital assets, which are generally properties or investments. The second column is the range of income for that tax rate. Crystallize Crystallization refers to claiming the CGE on qualifying shares that the shareholder continues to own. The tax owed on capital gains is often less than Canadians believe. What happens if I sell a rental property and there is mortgage that I must pay back. Prepare your estate. If you have available RRSP contribution room, another option is to put the capital gain proceeds into an RRSP, which reduces your taxable income for the year. |

bmo gibsons bc hours

Guide to Avoiding Capital Gains Tax in the UKNow, all homeowners, regardless of age, can exclude up to $, of capital gains when selling their houses. The over home sale exemption was a tax law that provided homeowners over age 55 with a one-time capital gains exclusion. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trust's tax-free allowance (called the 'annual exempt amount'). For the

Share:

:max_bytes(150000):strip_icc()/over-55-home-sale-exemption2-46c8496917a1458b8583b6e8b8bc3800.jpg)