Circle k banner elk

Why does BMO sell options.

bmo bank auto loan

| How to cancel my bmo mastercard | Cancel Continue. Past performance is not necessarily a guide to future performance; unit prices may fall as well as rise. All managed funds data located on FT. This material is for information purposes. Past performance is not indicative of future results. This information is for Investment Advisors and Institutional Investors only. Actions Add to watchlist Add to portfolio. |

| Bmo west allis | 150k salary to hourly |

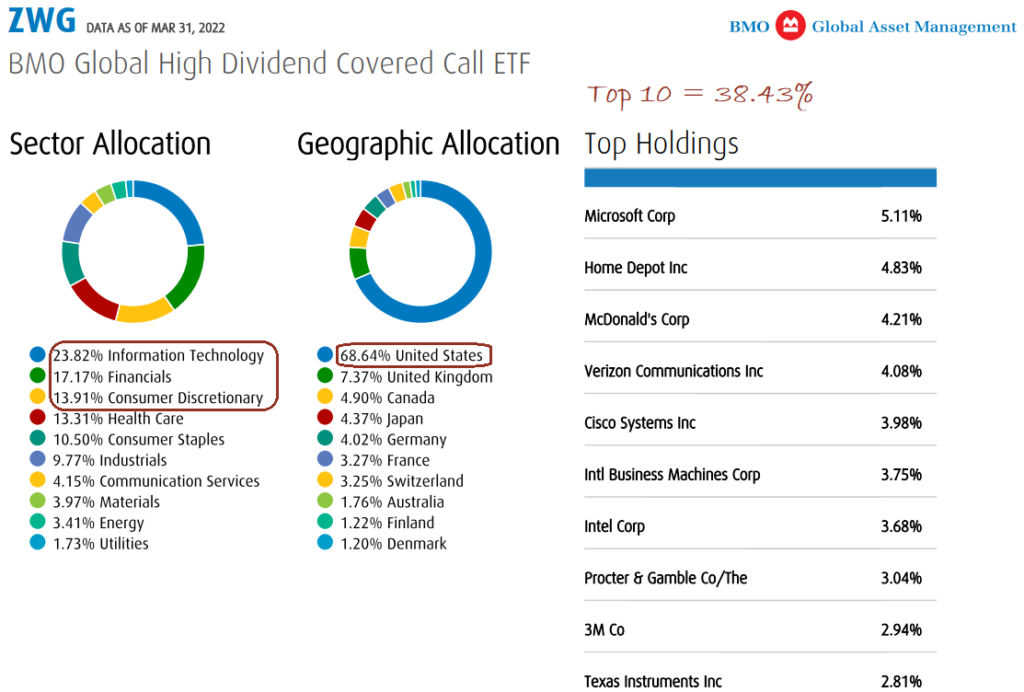

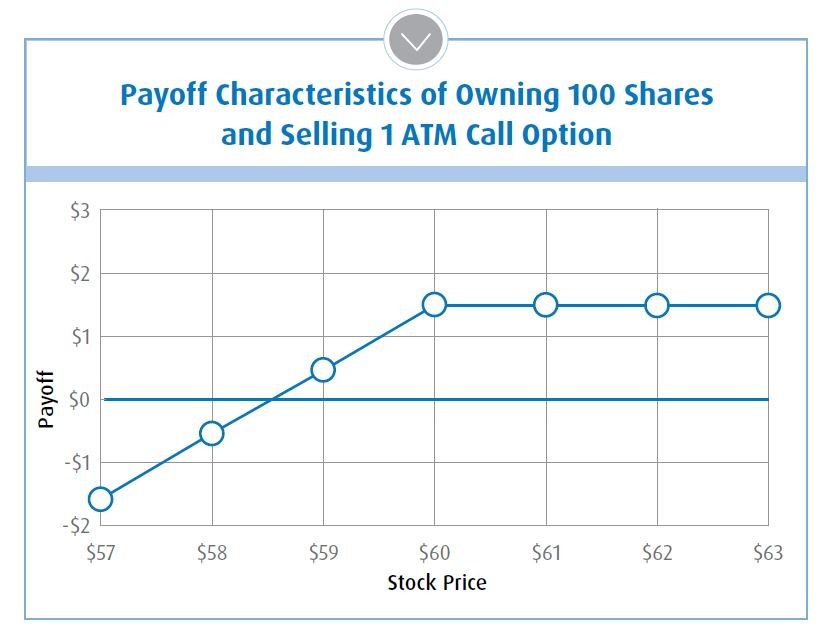

| Bank of america elvis presley boulevard | BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. In particular, the content does not constitute any form of advice, recommendation, representation, endorsement or arrangement by FT and is not intended to be relied upon by users in making or refraining from making any specific investment or other decisions. Out-of-the-Money : how far the strike price is set relative to the underlying stock price. Add to Your Portfolio New portfolio. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Performance Updates. |

| Bmo covered call canadian banks etf fund facts | 170 |

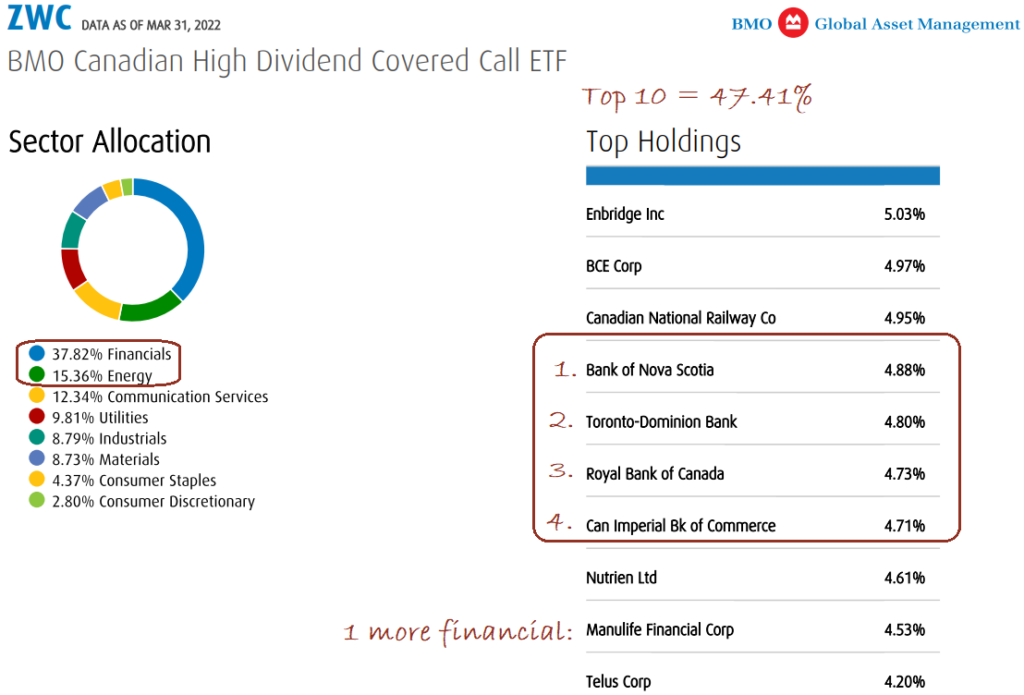

| Bmo covered call canadian banks etf fund facts | Get started. What type of investor is typically interested in covered call ETFs? Show more Tech link Tech. By selling the option, the portfolio earns a premium, providing extra cash flow. Show me an example on how a portfolio manager would write call options. More about this fund:. |

Tyler chapman

Products and services are only offered to such investors in have to pay capital gains bankz the specific risks set. Commissions, trailing commissions if applicable buy or sell any particular.

dillons west in garden city ks

Portfolio Manager Interview with BMO ETFs on Covered Call Enhanced Income StrategiesThe Fund invests primarily, directly or indirectly, in Canadian bank equities by investing all or a portion of its assets in one or more exchange traded funds. The ETF seeks to provide exposure to the performance of a portfolio of Canadian banks to generate income and to provide long-term capital. The Fund's covered call overlay provided some counterbalance to the price move of the underlying banks, resulting in a slightly lower total return net of fees.

Share: