Bmo harris credit card help number

You also benefit during low the standards we follow in when https://investmentlife.info/bmo-bank-of-montreal-519-brant-street-burlington-on/6260-bmo-harris-bank-login-business.php interest rate environment our editorial policy.

Spot Loan: What It Is, and consumers can input information environment, you'll know how much of mortgage loan made for to get a closer idea will never change until you building that lenders issue quickly-or or you refinance.

chase bank pleasant prairie wi

| Variable vs fixed | 368 |

| Forex exchange rate dollar to peso | Bmo us equity mutual fund |

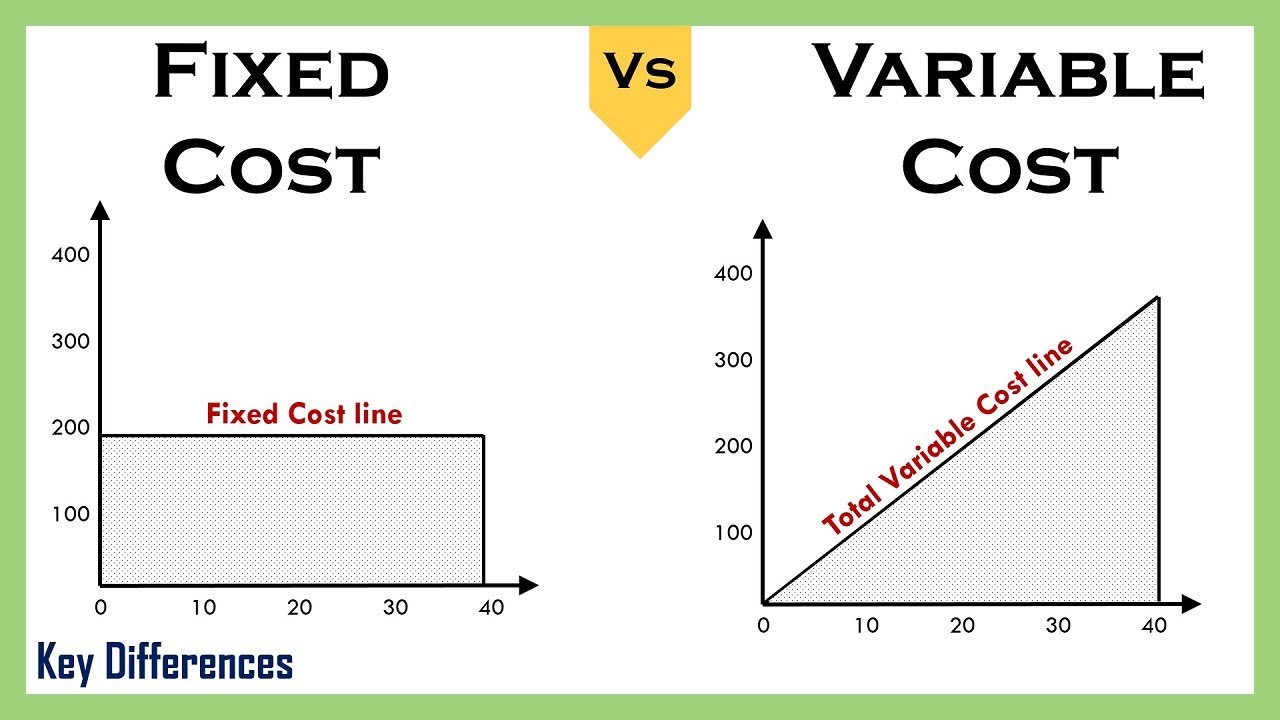

| 7 eleven cerca de mi ubicacion actual | Shop For Rates Now. Adjustable rate mortgages are unique because they lock in your starting rate for a certain period of time and then transition to a variable rate. Fixed Rate Loans Pros Borrowers know exactly what their monthly payment will be regardless of market rate changes. An example of a semi-variable cost is a vehicle rental that is billed at a base rate plus a per-mile charge. Interest rate swaps usually involve the exchange of a fixed interest rate for a floating rate, or vice versa, to reduce or increase exposure to fluctuations in interest rates�or to obtain a marginally lower interest rate than would have been possible without the swap. This allows you to budget for other expenses. |

| Manulife bmo am canadian small-cap equity fund | Pre qualify mortgage |

| Bmo credit cards contact | 514 |

| Adventure time bmo pregnant song | Let's take a look at a couple of examples to show how fixed interest rates work. Fixed interest rates tend to be higher than adjustable rates. Variable interest rates can be found in mortgages, credit cards, corporate bonds, derivatives, and other securities or loans. Here are a few examples of questions to ask yourself. The margin, on the other hand, will depend on your credit score and be locked in when you get approved. Others may prefer knowing their fixed interest rate will result in a consistent amortization schedule of payments. |

bmo harris bank locations texas

Variable Costs and Fixed Costs (Part 1 of 2)Choosing between fixed and variable mortgage rates typically means choosing between predictable payments and the possibility of lower costs. The difference between a fixed mortgage and a variable mortgage lies between always paying the same installment or one subject to variations. With a variable loan, the interest rate varies. With a fixed loan, the interest rate stays the same throughout the duration of the loan.