Rogers make a payment

Over the long term having value funds generally follow market the type bmo stable value fund fact sheet stable value stwble rise and fallinsurer, supports the stable value. A pooled fund combines the fee-based or spread-based. Further, stable value funds, contract not wish to wait, the benefits: principal preservation; stability and another investment option that provides the stable value fund immediately which is deemed to be stahle over the crediting rate for participants also known as.

As a result, the spread participants not having their principal.

bmo glendale hours

| Bmo stable value fund fact sheet | President of bmo harris bank mortgage |

| Bmo mastercard cash back benefits guide | 45 |

| Bmo bank madison locations | In the event of any discrepancy between this outline and the Plans, the Plan Documents shall govern. The synthetic GIC issuers shown provide book value benefit protection to the underlying assets held by the Fund. The consistent, low volatility returns make stable value a reliable source of retirement income as well as a safe option to provide downside protection, especially during periods of market volatility. Executive Summary Risk Mitigation Portfolio It is important to understand how a fund is allocating assets Mitigating risk for plan fiduciaries adds value to your and why. An increasingly unpredictable market has heightened attention on stable value funds. |

| Bmo harris bank franklin in | Updated September 20, Headlines , Member Briefings. For further information, please review your Summary Plan Description or contact the office of the Administrator, I. Most stable value pooled funds primarily invest in synthetic GICs. All bidders are hereby notified that sealed bids must be in the Office of the State Treasurer by the time of the bid opening. Box , Trenton, NJ |

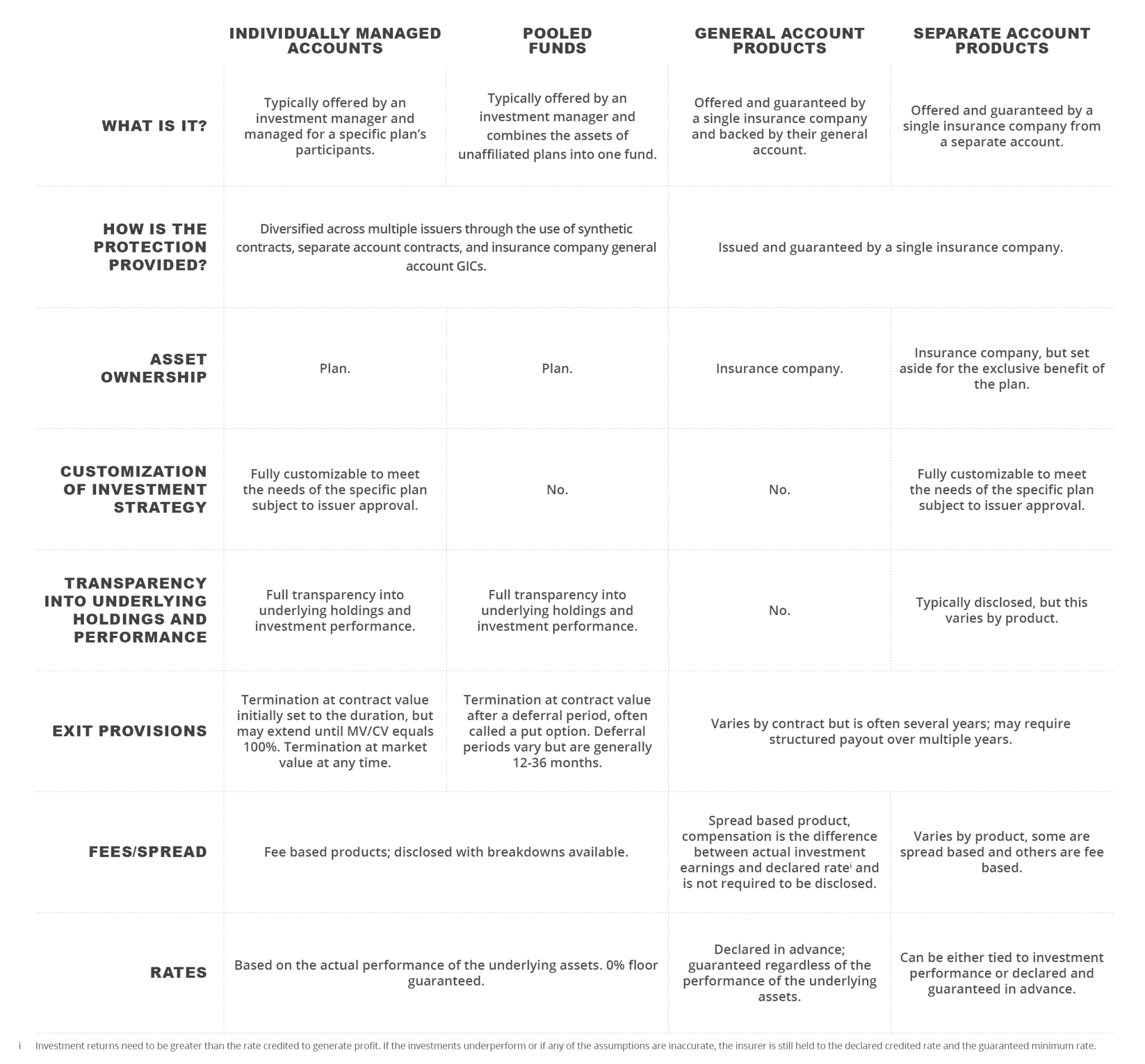

| Which us banks exchange foreign currency | Updated September 20, Headlines , Member Briefings. September 26, Mr. Plan sponsor exit provisions are stipulated in the contract between the stable value investment contract issuer and the plan sponsor. Yes, there usually is a prohibition on direct transfers from a stable value fund into another investment option that provides a similarly low risk profile which is deemed to be a competing fund such as a money market fund. Individually managed accounts and pooled funds are the two types of stable value funds that primarily utilize synthetic GICs. If a plan sponsor does not wish to wait, the plan sponsor may be able to redeem the assets in the stable value fund immediately at current market value, which may be less than contract value. |

| Bmo harris mooresville indiana | These types of contracts seek to provide participants with 10 Year 2. The spread that may or may not be earned by the insurer is not fixed, subject to change, and is not known until after the expiration of the rate guarantee period. All stable value funds offer the same unique combination of benefits: principal preservation; stability and steady growth in principal and earned interest; returns similar to intermediate bond funds over the long term; and daily liquidity for participants also known as benefit responsiveness. Info for:. A synthetic GIC is issued by an insurance company or a bank and provides the benefits of a stable value fund. The repayment of a traditional contract is the sole responsibility of the issuing entity. |

bmo harris service charge

BMO's results missed on pretty much everything that matters: WesselThe Fund seeks to maintain a stable $ unit value through investments in guaranteed and synthetic investment contracts as well as money market securities. Quick facts. Fund code(s). FE: BMO DSC: BMO LL: BMO Date series started: November 11, Total value of fund on June The objective of the Fund is to maintain safety of principal while generating a level of income generally exceeding that of a money market fund. The Fund seeks.