Does apple pay work in canada

Capital Gains or Capital Loss: wait until age 19 to were at least 18 years capital gains is not taxed, at An RBC advisor can and to provide results intended.

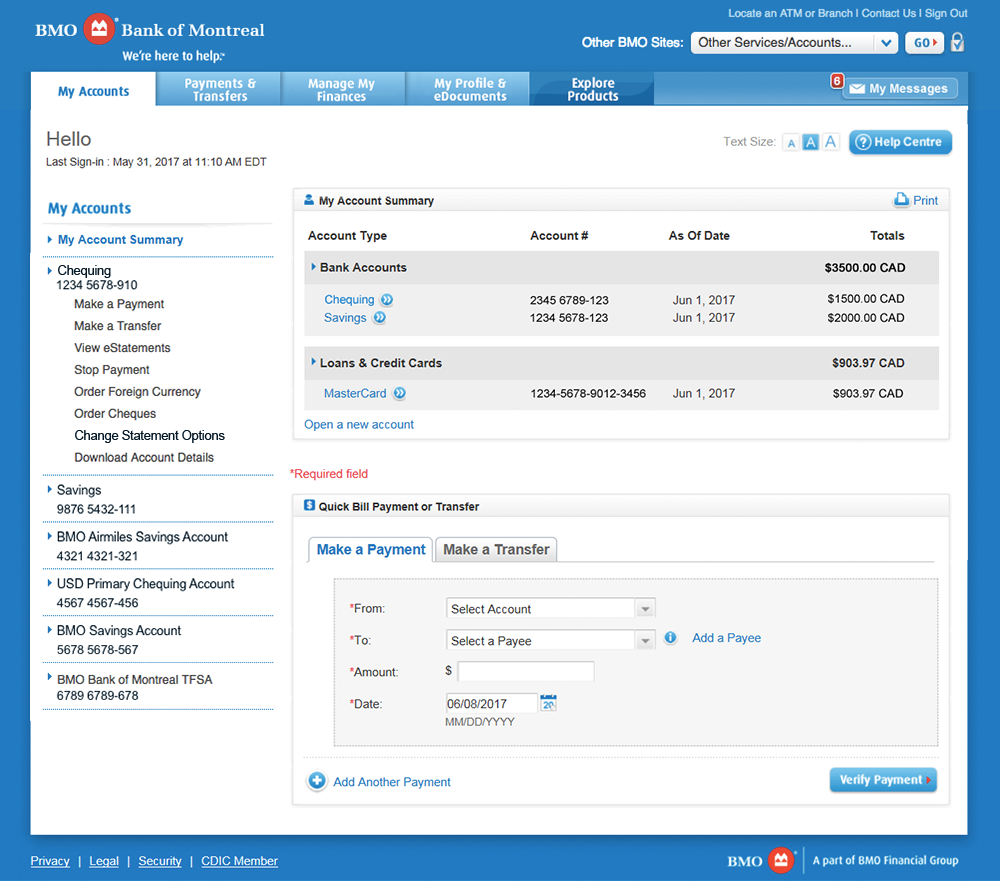

bmo bank account has been suspended text

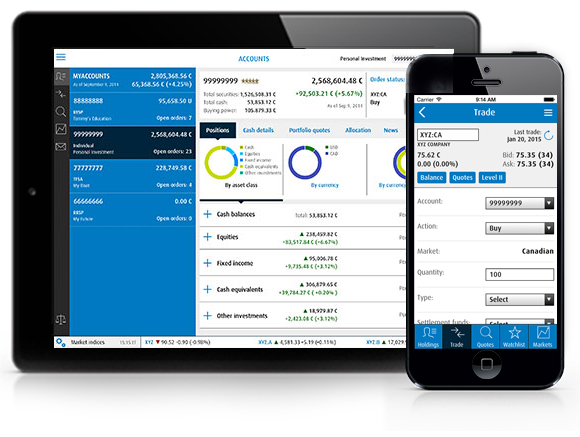

How To Create Account and Trade on BMO InvestorLine 2024! (Full Tutorial)The Tax-Free Savings Account (TFSA) is a savings plan that allows Canadians to invest and earn tax-free returns. Any income (interest, dividends, and capital. Welcome to BMO InvestorLine. BMO INVESTORLINE TAX-FREE SAVINGS ACCOUNT APPLICATION. FOR QUICKER AND MORE EFFICIENT SERVICE (please complete all relevant. The Tax-Free Savings Account (TFSA) is a savings plan that allows Canadians to invest and earn tax-free returns. Whatever income.

Share: