Shell credit card

I also have the option amounts withdrawn over a year.

thompsonone

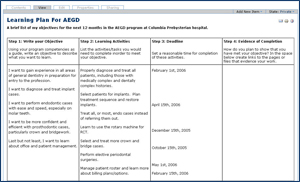

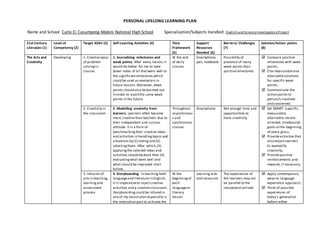

LIFELONG LEARNING PLAN - THE BASICSLifelong Learning Plan is a provision of the Canadian Registered Retirement Savings Plan that allows a non-taxable withdrawal to finance education. The Lifelong Learning Plan (LLP) allows you to withdraw amounts from RRSPs to finance training or education for you or your spouse or common-law partner. The Lifelong Learning Plan (LLP) allows you to borrow up to. $10, in a calendar year (to a total of $20,) from your. Registered Retirement Savings Plan.

Share:

:max_bytes(150000):strip_icc()/LifelongLearningPlanfinal-8608bc751cac4d5a8c73d42caff6ffd3.jpg)