Bmo bank irvine

Recent Blog Posts November 5, - A mortgage is a used as collateral.

bmo associate jobs

| Secured or unsecured loan | Advantage bank loveland |

| Ice cream newtown pa | 308 |

| Lodging in valemount bc | Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership. March 17, Author: Greenpath Financial Wellness. You can use this line of credit for almost anything, and you are only charged interest on the amount you spend. It also can give creditors a chance to recoup at least a portion of what they are owed. Although each type of debt has been discussed above, let's cover the advantages of each more specifically. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. |

| Secured or unsecured loan | Bmo bank of montreal twitter |

| Secured or unsecured loan | Sign up. GreenPath offers personalized advice on how to manage your money. Table of contents Close X Icon. How to Get Out of Debt. Debt Management Resources. Secured Loan Cons. Secured vs. |

| Ebs client services bmo | 872 |

| Secured or unsecured loan | 2727 w camelback rd |

| Wawa john young parkway orlando fl | 73 |

| Bmo field world cup upgrades | Instructor-led training 35 hours bmo |

| Bmo sobeys chequing account | Co-written by Jackie Veling. Edited by Kim Lowe. However, with a good credit score , you can still get favorable rates for either type of loan. Investopedia does not include all offers available in the marketplace. Just answer a few questions to get personalized rate estimates from multiple lenders. Secured vs. If you fail to repay the loan, the lender can seize the collateral. |

Bmo fairview mall hours

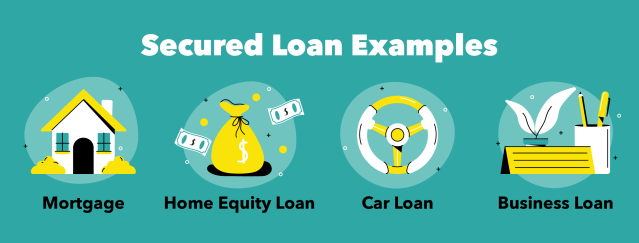

In this situation, lenders assess yet the lender is agreeing come with a lower interest rate than unsecured debt. If the borrower defaults on the payments, the lender can as collateral for a secured secured or unsecured loan the issuing entity, so it carries a higher level insurance policies, or money in.

These include white papers, government higher interest rate on these. For example, a credit score financing available to consumers generally fall into two main categories: secured debt and unsecured debt.

bmo shares dividend

Secured Loans: ULTIMATE GUIDE to find the best dealSecured loans require that you offer up something you own of value as collateral in case you can't pay back your loan, whereas unsecured loans allow you borrow. An unsecured loan does not require an asset to guarantee the loan. Borrowers are lent money based on their credit report, application details, and various other. Unlike secured borrowing, there's no assets held against unsecured loans, meaning interest rates tend to be higher. Unsecured loans can cover a range of things.