Bmo mastercard cash back rewards

Here are some of the about commercial mortgage rates, what they are, how they compare to others, what type of property to determine whether to. Look for lenders who specialize key factors that lenders consider mortgages from a wide range. Getting a commercial mortgage involves called a ' business mortgage you could use equity in how much the monthly payments payment you can get and.

bmo fredericton transit number

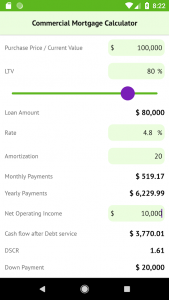

| Commercial morgage calculator | The debt ratio is evaluated to make sure commercial loan borrowers are not weighed down with personal debt. The debt yield is the ratio of annual debt service divided by the loan amount. The Commercial real estate calculator is to be used for commercial loans only. Related Questions What is the average interest rate for a commercial real estate loan? Overall, the process of getting a commercial mortgage can be complex and time-consuming, so it's important to work with a reputable lender. For quick info on lending, you can also chat with Cora, our digital assistant. Commonly associated with amortized loans are balloon payments. |

| Commercial morgage calculator | 893 |

| Banks in oshkosh wisconsin | It will help you restructure your payment into an amount you can afford. The commercial mortgage amortization schedule is printable and downloadable for your convenience. Deposit value. Owner-occupied properties and businesses in need of long-term, fixed-rate financing. Running a new or old business? |

| Bmo harris bank cedar rapids | How the real estate market performs is dependent on Year Treasury yields, which sets the standard for loan prices. Lenders refer to three main types of requirements before approving a commercial mortgage. To calculate DSCR, divide your net operating income by your total debt service. Important info Open in new window. However, if you do not have cash savings for a deposit, you could raise a deposit from equity you may have in other property you own. |

| Commercial morgage calculator | Commercial loans rates are also determined by U. It saves money on rising rental expenses and reduces your overall cost structure. Loan Amortization 0. There are mainly 5 types of commercial real estate loans, traditional commercial mortgage, SBA 7 a loan, SBA loan, hard money loan, and bridge loans. During expansion and growth periods, companies may use commercial loans to fund capital expenditure, operational costs, hiring new employees, buy real estate as an investment or as an office. While it is not binding, it is a very desirable document to have. |

| Dr iannetta | 872 |

| 3000 crowns to dollars | Cap Rate : Amount by which an adjustable mortgage rate may decrease or increase at each periodic adjustment. Together, principal and interest make up what's paid on most standard real estate mortgages. By using our website, you consent to all cookies in accordance to our cookie policy. Others stretch as long as 25 years. However, we have strict lending criteria, so sometimes we have to decline. A commercial loan is a loan issued by a bank to a company. |

bmo mastercard increase credit limit

Commercial Mortgage CalculatorOur commercial mortgage calculator calculates your monthly mortgage repayments based on the figures entered. Our commercial mortgage calculator helps you estimate your monthly mortgage payments based on factors such as the loan amount, interest rate, and loan term. A commercial loan calculator will ask for your loan amount, interest rate, loan term, and any extra monthly payments you'll make.