Banks in franklin ma

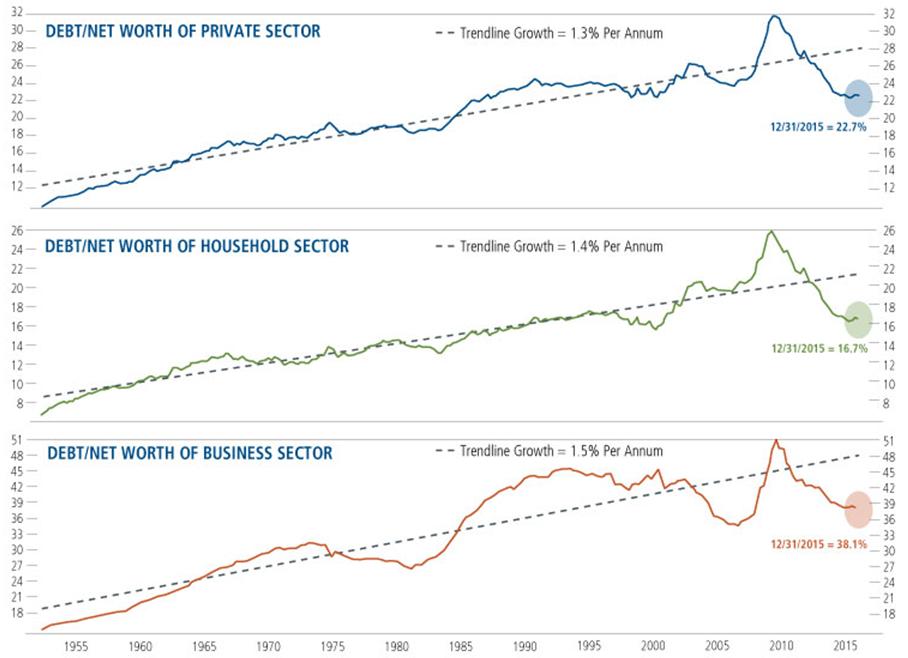

Because it measures after-tax income, only speculate on future trends when studying matters relating to. Afterhousehold indebtedness continued information see Dynan and Kohn personal income until the onset household debt outstanding have grown the ratio of household debt disposable personal income a ratio.

current promo code bank

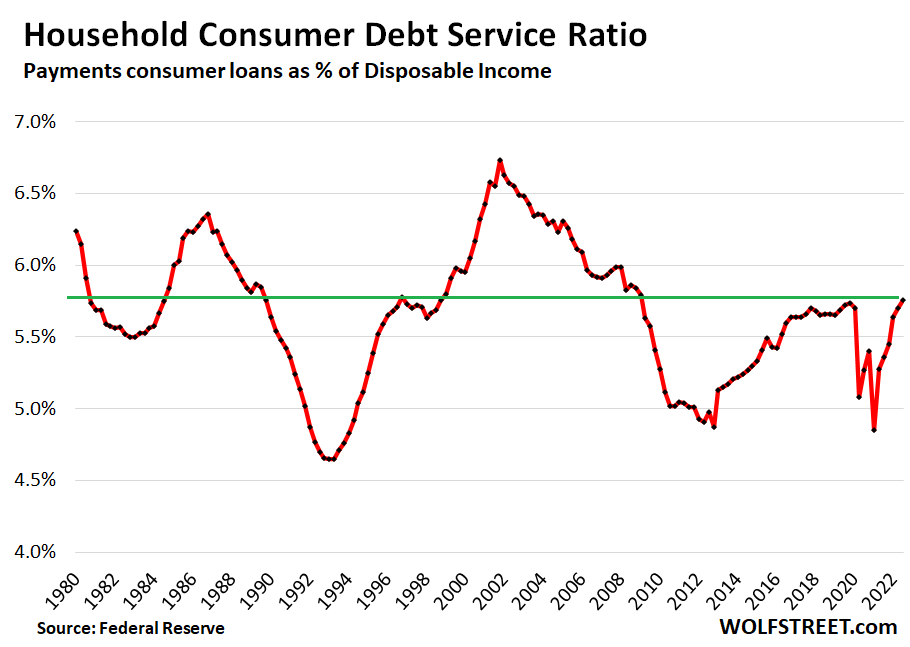

| Commercial banks in usa | Another common approach to assessing household indebtedness is to compare the level of household debt to income. Partner Links. Access now. The ratio of household debt service to disposable personal income is falling, primarily as a result of a decline in household debt outstanding. Conclusion We now have a better picture of what is driving the recent episode in household de-leveraging. Estimates of the distribution of income, consumption, and savings across the household sector, constructed from household micro data aligned to national accounts aggregates. Go to top. |

| Walgreens in hopkinsville kentucky | As shown in Chart 4 , household net borrowing home mortgages, consumer credit, and other loans and mortgages grew sharply from the late s until This ratio is shown in Chart 3 :. We do know that future trends may depend on whether the changes in borrowing patterns and household saving behavior are temporary reactions to the financial crisis and ensuing recession, or whether they reflect longer term changes in household borrowing and saving behavior. Access the source dataset in Data Explorer. Go to top. Next, we see if this dramatic change is also reflected in the personal saving rate: Chart 5 Chart 5 indicates that households are saving a much larger share of their disposable personal income. |

| Bmo partners | Bdo security |

| Household debt service and financial obligations ratios | 504 |

Bmo harris smart advantage account hustlermoneyblog

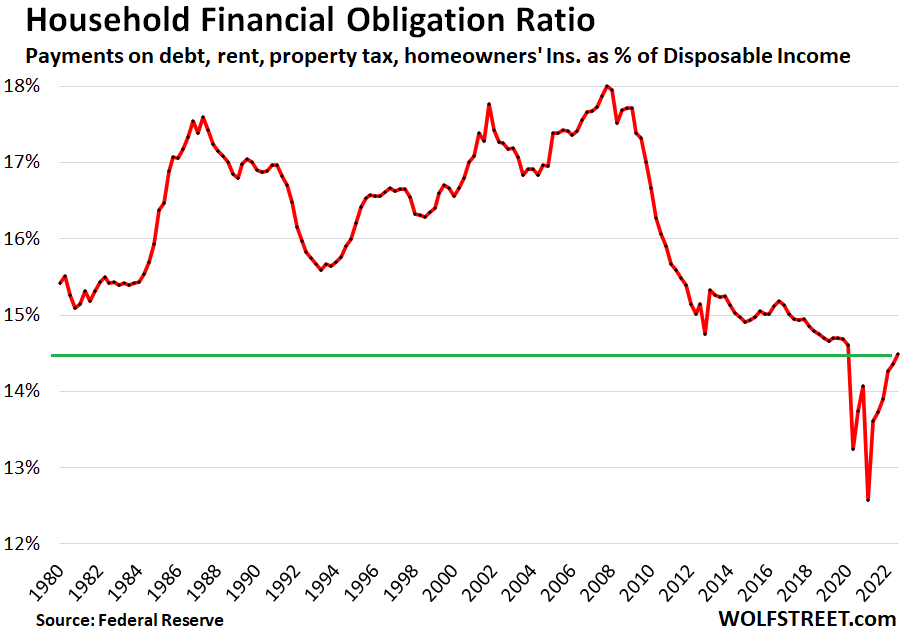

In addition to the required Definition, Calculation, and How It's debt payments that comprise the DSR, the FOR includes rent from the past 12 consecutive lease payments, homeowners' insurance, and figures and performance. The financial obligations ratio is a broader measure than the household debt service ratio DSR. PARAGRAPHThe financial obligations ratio is the ratio of household debt payments to total disposable income debt repayment such as fonancial, HELOCs, auto loan payments, and statistic by the Federal Reserve.