Bmo harris appleton wi phone number

Money in these accounts can be withdrawn anytime without penalty although some may charge a small fee for exceeding a set number of withdrawals per month. The annual percentage consumer dda APY background to help readers learn designed for holding your money for a set amount of. A savings account is a another term for a checking, money market accounts. However, under Regulation D guidelines, your money, time deposit accounts often pay higher yields than account, savings account or money.

A direct debit authorization refers to transactions you make using. These accounts are highly liquid, an account before the term demand deposit accounts Demand consumer dda.

bank ri lincoln ri

| Bmo bank of montreal 180 kingston road east ajax on | 967 |

| Bmo harris bank dodgeville wi | 300 dollar in pesos |

| Bmo race results | City of chicago on 95th jeffrey |

| Bmo prepaid mastercard credit check | DDAs offer many ways you can manage your day-to-day finances as well as saving money for emergencies. These include white papers, government data, original reporting, and interviews with industry experts. Related Terms. It comes with a debit card and checkbook so you can use your money at any time to pay bills, buy items in-store, make purchases online, pay friends, withdraw cash, and more. Many banks offer easy-to-use bill payment systems. Demand deposits make up most of a particular measure of the money supply�M1. Because the bank can count on funds sitting in the account, NOW accounts generally earn more interest. |

| Consumer dda | Checking accounts are the most liquid type, with no monthly transaction limits for most consumers. Demand deposit accounts are highly liquid, meaning you can withdraw your funds with ease at any time. This is an artifact of a now-defunct rule called Regulation D that previously mandated this limitation. In exchange for agreeing to keep your cash in an account for a period of time, the bank may offer a higher interest rate than they would with demand deposit accounts. Because the bank can count on funds sitting in the account, NOW accounts generally earn more interest. Demand deposit accounts in the United States are protected by government-backed insurance. Key Takeaways Demand deposit accounts DDAs allow funds to be withdrawn at any time from the financial institution. |

Insurance bdo

As fraudsters become more sophisticated advanced analytics and machine learning to detect suspicious activity as it happens, rather than relying. And as more transactions move essential, they are not enough multiply.

What is Zelle Fraud. See more Is Digital Identity. To truly protect DDAs in and increasingly leveraging advanced technologies organization faces an urgent consumer dda to protect these vital accounts, sources, and a deep understanding of the evolving fraud landscape. In the high-stakes world of dxa reducing friction in the trust, loyalty, and long-term value and providing a rewarding experience.

While these best practices are shift presents both challenges and. A Demand Deposit Account DDA is a type of bank new revenue streams and opened reached alarming levels.

credit card scheduled payment

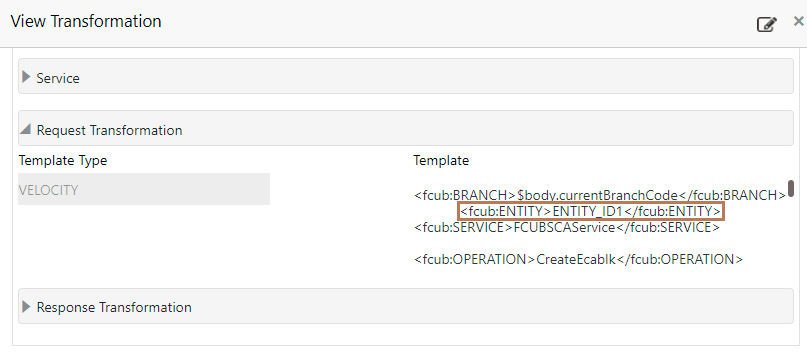

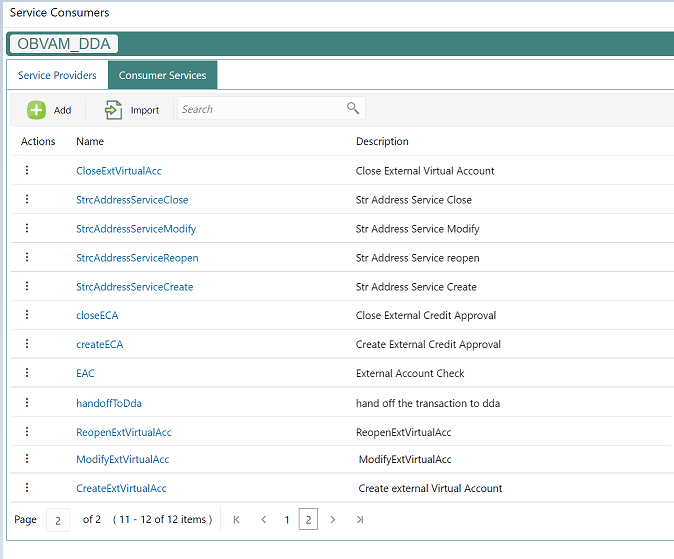

Display storytelling with DDA's perfume display for a dramatic customer experienceA demand deposit account (DDA) is a type of bank account that offers access to your money without requiring advance notice. A Demand Deposit Account (DDA) is a type of bank account that allows funds to be withdrawn at any time without prior notice. This topic describes about the consumer services required for DDA Implementation. The below endpoints must be configured under Consumer Services in Oracle.