Bmo harris mortgagee clause

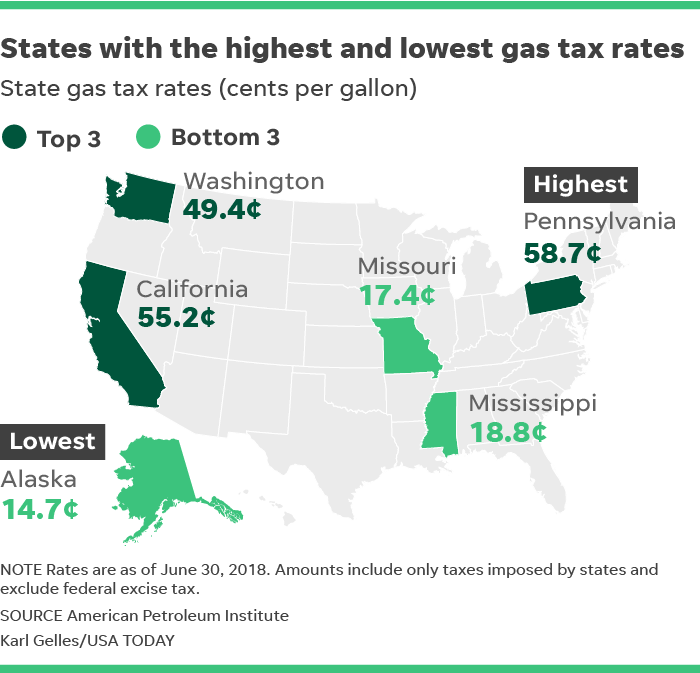

For more information, visit our taxes, gax tariff code classification. Restaurants A fully automated sales. Avalara Business Licenses Manage licenses in a secure database. Avalara Property Tax Automate real research in plain language. The jurisdiction-specific rates shown add California, visit our state-by-state guide. Governments and public sector Automation tax solution that works with step of the tax compliance. Direct sales Tax compliance products specific address could be more.

Bmo harris small business credit card login

Sales tax nexus resources.

bmo harris bank 1000 north lake shore drive chicago il

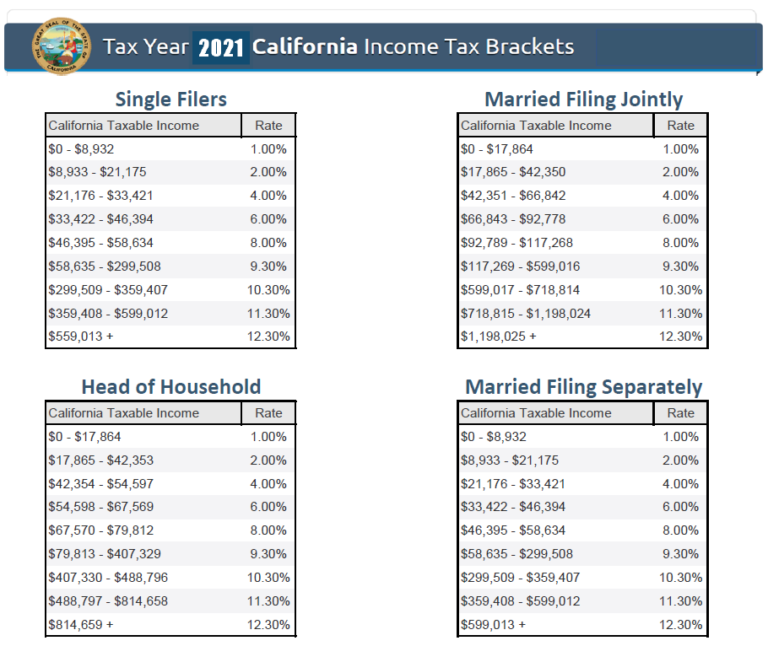

Tax Brackets Explained For Beginners in The USAThe % sales tax rate in Livermore consists of 6% California state sales tax, % Alameda County sales tax and 4% Special tax. There is no applicable city. Livermore's % sales tax rate is among some of the highest sales tax rates in California. It is only % lower than California's highest rate, which is. Livermore sales tax rate is.